An individual tax return is defined as a document that taxpayers in several countries, including the United States, must file with the government's tax authorities yearly. It provides detailed information about taxpayers' income, expenses, deductions, credits, and other relevant financial data. The purpose of submitting an individual tax return is to calculate the amount of taxes owed or the potential refund received by the taxpayer.

The Internal Revenue Service (IRS) operates as the federal tax authority in the United States. Within the US, a system of voluntary tax reporting allows individuals to file their individual tax returns electronically or through physical forms.

Every country has its designated tax collection agencies responsible for overseeing national taxation. These agencies may offer pre-filled tax returns for individuals in certain cases, while, in others, taxpayers are required to complete and submit their tax returns independently.

Individual Tax Return Explained

An individual tax return is a standardized form used by individual taxpayers to reveal critical financial information such as earnings and taxable income. They are normally issued by the Internal Revenue Service (IRS) in the United States. The purpose of filing an individual tax return is to determine whether taxpayers have overpaid or underpaid their taxes. Individuals eligible to file individual tax returns are:

Married Couples: Those filing jointly or separately.

Head of Household: Individuals who provide for a household.

Qualifying Widowers/Widowers: Those who meet certain conditions.

Single Filers: Individuals who do not fit the other groups' criteria.

In addition to the main form, married couples and single filers are usually required to fill out extra forms, such as appropriate Schedules. If a taxpayer itemizes deductions, for example, they would use Schedule A and Form 1040 to categorize deductions such as charitable contributions and mortgage interest.

Individual taxpayers use different versions of Form 1040-SR or Form 1040. Married couples have the option of filing jointly or individually. After completion, the form needs to be submitted to the tax agency by the deadline.

Some taxpayers who earn money from business activities must include it on their tax return forms. Examples include freelancers operating sole proprietorships or small business owners using limited liability corporations (LLCs) regarded as pass-through businesses. These taxpayers might need Schedule C to report business income and expenses. If you own a C Corp or similar organization that is taxed separately, you must file both an individual tax return and a business tax return.

Individuals who live in income-tax states must additionally file state tax returns. These state returns usually duplicate the information on the federal tax return. However, the required information varies because each state has its own forms and rules. State tax returns frequently calculate taxes based on line items from IRS tax forms.

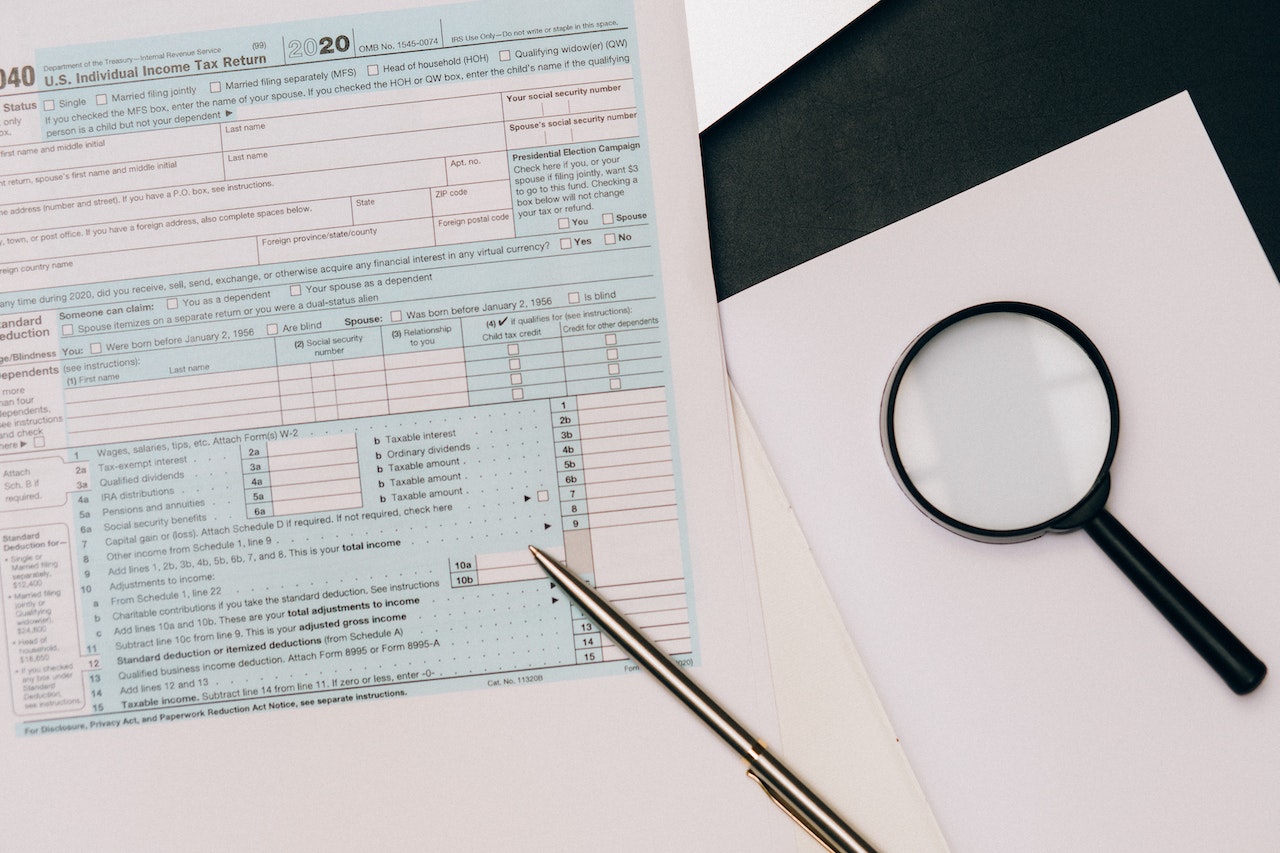

Individual Tax Return Forms

The primary document individual taxpayers use to submit their financial information is Form 1040, a concise two-page form. This form is widely used and covers various income sources such as salary, tips, wages, interest, capital gains, dividends, pensions, unemployment compensation, annuities, railroad retirement, Social Security, Alaska Permanent Fund, and taxable scholarships.

Additionally, there is an alternative version of Form 1040-SR explicitly designed for senior citizens. This version offers a large type size for improved readability and emphasizes tax benefits for retirees.

Self-employed people and business owners can report and pay their taxes quarterly using Form 1040-ES. After completing Form 1040, subsequent payments are made using Form 1040-V.

It's worth noting that many former versions of individual tax returns, such as Form 1040-A and Form 1040-EZ, have been phased out since the 2017 tax year.

How to File an Individual Tax Return

To file an IRS individual tax return, taxpayers can download the standard form from the official website of the federal tax agency. While the form might initially confuse the taxpayers, it serves the following functions.

Gather Personal Details: Essential personal information, including the social security number, tax filing status, number of dependents, and other pertinent data, must be provided.

Calculate Taxable Income: The form totals the individual's annual earnings and accounts for any deductions they want to claim. This calculation gives the taxable income the government levies taxes on. For an exact calculation, refer to the federal tax brackets corresponding to the individual's income level.

Determining Tax Liability: The next step is to enter the tax amount, with the option to offset this liability using tax credits. Individuals can also deduct the taxes they have already paid through withholding during the year.

Finalizing Tax Bill: Finally, the form determines whether the taxpayer has covered their entire tax obligation or if there is still an outstanding amount. This evaluation shows whether the combination of tax credits and withholding taxes meets the tax liability. If there is a shortfall, the taxpayer settles the remaining balance while filling out Form 1040.

Individual Tax Return Example

Suppose John is an accountant for a tax agency and earns $80,000 annually. As tax season approaches, John completes his tax return on Form 1040. He fills out this form with personal information such as his name, address, Social Security number, and date of birth. John then fills in other sections, including income, credits, deductions, and tax liabilities. John learns whether he will have a tax liability or qualify for a tax refund when he completes the form.