The gift tax is a federal tax imposed by the IRS on individual taxpayers transferring assets to others without receiving any significant value in return. Cash, real estate, and other forms of assets may be considered gifts. The IRS limits gift amounts that must be reported and count toward a lifetime gift tax exemption. Exceeding this limit results in gift tax liability. The gift tax can apply even if the transfer wasn't initially intended as a gift.

How a Gift Tax Works

A gift tax involves the exchange of valuable items between individuals. The IRS defines this transfer as either direct or indirect, where total value is not received in return. The federal gift tax was implemented to deter tax evasion and to ensure that both givers and recipients meet their tax obligations.

Property is considered a gift if it has monetary value and is given without remuneration. The Internal Revenue Service sets annual and lifetime gifting limits. The yearly cap is $16,000 per individual in 2022, rising to $17,000 in 2023, and remains non-taxable. For 2022, the lifetime cap is $12.06 million; for 2023, it is $12.92 million. For example, if you have three children, you can give each one $17,000 tax-free in 2023, for a total of $51,000. If you exceed the yearly cap, it contributes to your lifetime limit.

As the giver, you are responsible for reporting all gifts, even those that fall below the yearly threshold. You must complete and file Form 709: United States Gift Tax Return (and Generation-Skipping Transfer) with your annual tax return by April 15 of the following year. Understanding that reporting does not automatically result in tax obligations is essential.

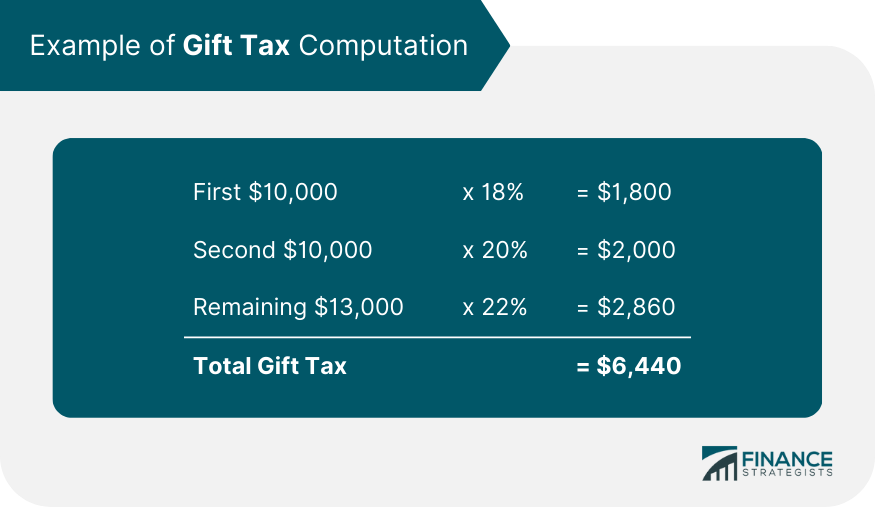

The gift size determines the gift tax rate, which ranges from 18% to 40%. Regarding assets like art or equities, the fair market value (FMV) is used to calculate tax liabilities.

Gift Tax Examples

Here are two illustrative examples that explain how the gift tax works:

Assume Taxpayer X gifted $100,000 to five people in 2023, with $20,000 for each recipient. Given the annual exclusion cap of $17,000 per person, $20,000 of the total amount is not excluded, reducing the lifetime exemption amount. As a result of these contributions, Taxpayer X retains $12.04 million within the exemption limit before gift taxes are applied.

In 2023, a grandmother wanted to support her granddaughter with her education. She contributed $20,000 to tuition and $17,000 to books, materials, and equipment. Both payments are excluded from gift tax reporting since the tuition is exempt, and the $17,000 is under the yearly exclusion limit.

However, if the grandmother contributed $30,000 after the granddaughter had paid her tuition, she would have made a reportable but non-taxable gift of $13,000 ($30,000 minus the $17,000 annually exclusion). This would reduce the grandmother's lifetime exclusion of $12.06 million by $17,000.

Gift Tax Limit 2023

In 2023, the annual gift tax exclusion is $17,000 per recipient. Any gifts exceeding this amount must be reported to the IRS on Form 709 on your 2024 tax return.

Who Pays the Gift Tax

The giver is responsible for paying the gift tax, not the recipient. Gifts you receive, while the giver is still alive are not subject to taxation. However, specific states may levy inheritance taxes on estate gifts, and dividends from gifts may be taxable.

Most people will not have to pay gift taxes because they have a large lifetime exemption. Nonetheless, keeping track of the funds or assets you give is critical. If you make a gift that exceeds the annual limit, you must file a gift tax return.

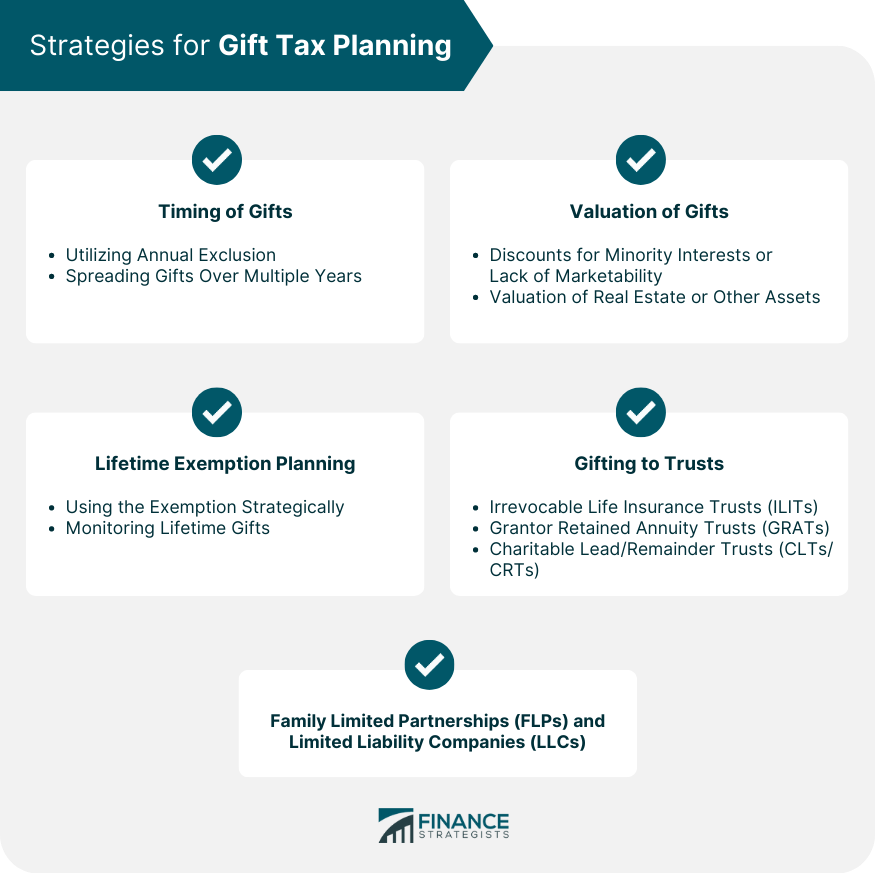

Ways to Avoid Gift Tax

There are several ways to reduce or avoid the gift tax. Some essential methods are as follows:

Gift Splitting

Gift splitting is an effective strategy for married people. The annual exclusion applies to the amount of acceptable gifts per person. Even if spouses file jointly, they can both give $17,000 to the same recipient in 2023. This effectively doubles the potential contribution to $34,000 annually while avoiding gift tax penalties.

This method allows wealthy couples to lavishly gift their children, grandkids, and others annually. Furthermore, this can be used with tax-free gifts, such as tuition paid directly to a grandchild's educational institution.

Gift in Trust

Gifts through trusts like the Crummey Trust can avoid the standard gift tax exclusion. However, donors can give amounts greater than the yearly exclusion by creating specialized trusts for funds receiving and distribution.

The Crummey trust, a common arrangement, allows beneficiaries to withdraw assets within a specified duration, such as 90 days or six months. This generates what the IRS calls a "present interest" in the trust, making such distributions tax-free. However, the withdrawn amount cannot usually exceed the initial gift given to the trust.

Conclusion

The gift tax is a federal obligation that applies when you give someone else money or valuable items for free. This tax targets the giver, not the recipient.

However, the gift tax structure assures that only a few people are required to pay it. Several sorts of gifts, including those to couples, are exempt. Furthermore, a significant amount can be given during one's lifetime before triggering the gift tax, and even then, it only applies to the excess amount beyond that limit.