The Return of Capital (ROC) refers to a payment made to an investor that is a percentage of their initial investment and differs from income or capital gains generated by the investment. This payment is not subject to taxation and doesn't qualify as taxable income. It is essential to note that ROC reduces the investor's adjusted cost basis. When the stock's adjusted cost basis reaches zero due to this reduction, any subsequent returns will be taxed as capital gains.

How Does Return of Capital (ROC) Work

When a person invests, they contribute their principle with the expectation of earning a return, which is referred to as the cost basis. The return of capital occurs when the principal is reimbursed to the investor. Since this repayment does not include any gains or losses, it is tax-free, just like the original investment.

It's important to differentiate between return of capital and return on capital, as the latter refers to taxable returns on invested money.

Certain investment types allow you to reclaim your initial capital before realizing gains or losses for tax purposes. Qualified retirement funds, such as 401(k) plans or IRAs and monies received through permanent life insurance policies, are notable examples. These are examples of a "first-in-first-out" (FIFO) strategy, in which the investor receives their initial investment before touching the profits.

The cost basis refers to the overall cost paid by an investor for an investment. It has been adjusted for stock splits, dividends, and purchase commissions. Investors and financial advisors must closely monitor the cost basis to realize any Return of Capital distributions.

When an investor buys and sells a profitable investment, the capital gain must be reported on their tax return. The capital gain is calculated as the sale price minus the cost basis of the investment. If the investor receives an amount equal to or less than the cost basis, it is considered a return of capital rather than a capital gain.

Return of Capital Example

Suppose you are an investor who purchased 100 shares of XYZ Company at $50 per share for a total investment of $5,000 (100 shares * $50/share). The company develops returns and changes in value over time, causing stock price fluctuations.

XYZ Company decided to distribute a return of capital to its investors some years later. The company has undergone certain financial transactions, such as selling non-core assets, which generate significant capital. This capital is then returned to the stockholders.

Suppose XYZ Company announces a return of capital distribution of $2 per share. As an investor with 100 shares, you would receive a capital return of $200 (100 shares * $2/share). This capital return is not taxable income; you do not need to report it on your tax return.

Now evaluate how it impacts your investment:

- Original investment: You initially invested $5,000 in XYZ Company.

- Return of Capital: You receive a $200 return of capital.

- Adjusted Investment: Your adjusted investment has been reduced to $4,800 ($5,000 - $200).

- Adjusted Cost Basis: Each share has an adjusted cost basis of $48 ($4,800 / 100 shares).

The ROC reduces both your adjusted investment and your adjusted cost basis. This can affect future tax calculations, especially if you sell your shares.

If you sell all of your shares in the future, consider how ROC affects your capital gains:

Suppose you later sell your 100 shares for $55 each, for $5,500. Your original cost basis was $5,000, but after adjusting the ROC, your adjusted cost basis is now $4,800.

Capital Gain Calculation

- Sales Proceed: $5,500

- Adjusted cost basis: $4,800

- Capital gain: $700

Your capital gain is $700, and you must report it on your tax return and perhaps pay taxes on it, depending on your investment's tax bracket and holding period. This example shows how a ROC can affect your investment and the tax implications.

Tax Implications

Return of capital distributions remains exempt from taxation. However, once the stock's adjusted cost basis falls to zero, any subsequent non-dividend distributions are classified as taxable capital gains.

The Internal Revenue Service (IRS) mandates that taxpayers keep track of their overall capital gains calculations, including the difference between the purchase and selling prices and the return of capital distributions.

Return of Capital Vs. Dividends

Return of capital, also known as capital dividend, refers to a payment made by a company to its investors from its shareholders' equity or paid-in capital. Unlike traditional dividends from a company's profits, the ROC does not originate from earnings.

Return of Capital Vs. Return on Capital

Return on Capital is the annual earnings generated by an initial investment and is taxable. On the other hand, Return of Capital represents the rate at which an original investment can be reclaimed.

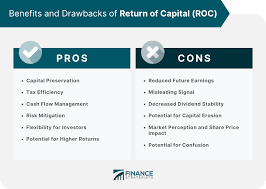

The Bottom Line

Investors receive a portion or all of their investments in a stock or fund when they receive a Return of Capital. It is essential to distinguish between the Return of Capital and dividends since their sources differ: the Return of Capital originates from paid-in capital or shareholder capital, whereas dividends come from company profits. While the return of capital distributions is not taxable, their potential to generate realized capital gains requires tax implications.