A deposit insurance fund is a private insurance fund that covers all deposits of people by (FDIC) Federal Deposit Insurance Corporation. Deposit Insurance Fund (DIF) money is set aside to replace funds lost due to banking institution failure. Deposit insurance, which is now $250,000 per account, is the government’s assurance that an account holder’s funds in an insured bank are secure up to a specific amount. Any FDIC member bank which insures deposits to a minimum of $250,000 is also a DIF member.

The FDIC helps ensure stability and public confidence in the country’s financial system by offering deposit insurance. FDIC is a government organization that collects fees in the form of insurance premiums from banks. A five-member board that includes the director of the Consumer Financial Protection Bureau, the Comptroller of the Currency, and 3 nominees by the President plus confirmed by the Senate oversees the FDIC.

Moreover, the Deposit Insurance Fund’s two main objectives include resolving failed banks and insuring deposits, as well as protecting depositors of insured institutions.

The DIF has two sources of funding while being guaranteed by the full trust and credit of the US government: assessments (insurance premiums) on institutions covered by the FDIC and interest on money deposited in US government obligations. The deposit insurance fund balance (or fund net worth) increases with revenue from assessments and income earned on assets, while losses (mainly from bank failures) plus operating costs decrease the balance.

In the matter of SVB & Signature Bank, the United States government ruled that a “systemic risk exception” applied and repaid all clients- which include those whose accounts exceeded the $250,000 cap, to stop additional damage to the banking system. The insured deposit limit has been increased numerous times over the FDIC’s history, most recently after the 2008 financial crisis when Congress approved legislation boosting the maximum amount allowed from 100,000 dollars to 250,000 dollars.

How Does Deposit Insurance Work

If the deposits of bank account holders are insured, they feel safer, and the DIC gives that assurance. For instance, you would be protected up to $250,000 if your bank closed down its doors in 2009. This minimizes the same kind of horror that led to the bank panic in 1930.

Comparing the DIF account balance to the overall assets of banks on the “FDIC Problem Banks List,” published quarterly, is a frequent use of the data. Because the FDIC may borrow from the Department of the Treasury, it will never run out of money, but significant losses would result in higher premiums for the other banks that remain in the coming years.

How does FDIC Funded

Despite having the full faith and credit of the United States government backing it, the FDIC does not get any funding from Congress. Instead, the fund is made up of quarterly fees the FDIC collects from banks that are insured, as well as interest from investing the money in Treasury bills and other U.S. government securities. For every $100 in insured deposits, the fund must maintain $1.35 according to the law. The premiums charged by banks are based on the bank’s size, the bank’s liabilities, and how risky the bank is perceived to be by bank regulators.

The DIC had 128.2 billion dollars, or around 1.27 percent of all insured deposits, as of December 31, 2022. By September 30, 2028, the FDIC intends to have raised premiums to the statutory minimum of 1.35 percent. The long-term goal of FDIC is for the Fund to account for up to 2% of insured deposits in order to “reach a level enough to endure a future crisis.”

You must be wondering what the corporation does when the bank fails; here’s the answer to your question. The Federal Deposit Insurance Corporation has two alternatives when a bank fails. The first option is to sell the bank to a buyer who is ready to accept all or any of the failed bank’s assets and liabilities. On the other hand, the second option entails paying out insured deposits and selling off the assets of the bank, with uninsured depositors getting money depending on the asset value.

Modern Reforms of DIF

By defining the assessment base, which serves to determine banks’ quarterly assessments, and setting standards for the (DRR) Designated Reserve Ratio, the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010 (the Dodd-Frank Act) amended the FDIC’s fund management processes. The deposit insurance fund balance divided by the projected insured deposits yields the DRR ratio.

As a result of these changes, the FDIC created a thorough, long-term plan to administer the deposit insurance fund in a manner that minimizes pro-cyclicality while obtaining moderate, constant assessment rates across economic as well as credit cycles and retaining a positive deposit insurance fund balance in the case of a banking crisis. Due to this proposal, the FDIC Board approved a 2% DRR and the current assessment rate schedules.

According to the Federal Deposit Insurance Act, the FDIC Board must annually designate a target or Designated Reserve Ratio for the deposit insurance fund. The Board has continued to use the 2% DRR every year since 2010. The reserve ratio, however, would have needed to be higher than 2% before the start of the two crises that took place during the past thirty years to have retained both a positive fund balance and steady assessment rates through both crises, according to an analysis employing historical fund loss and imitated income data from the year 1950 to the year 2010. The FDIC sees the 2% reserve ratio as a long-term objective and the bare minimum required for dealing with future crises of the same magnitude.

The Bottom Line

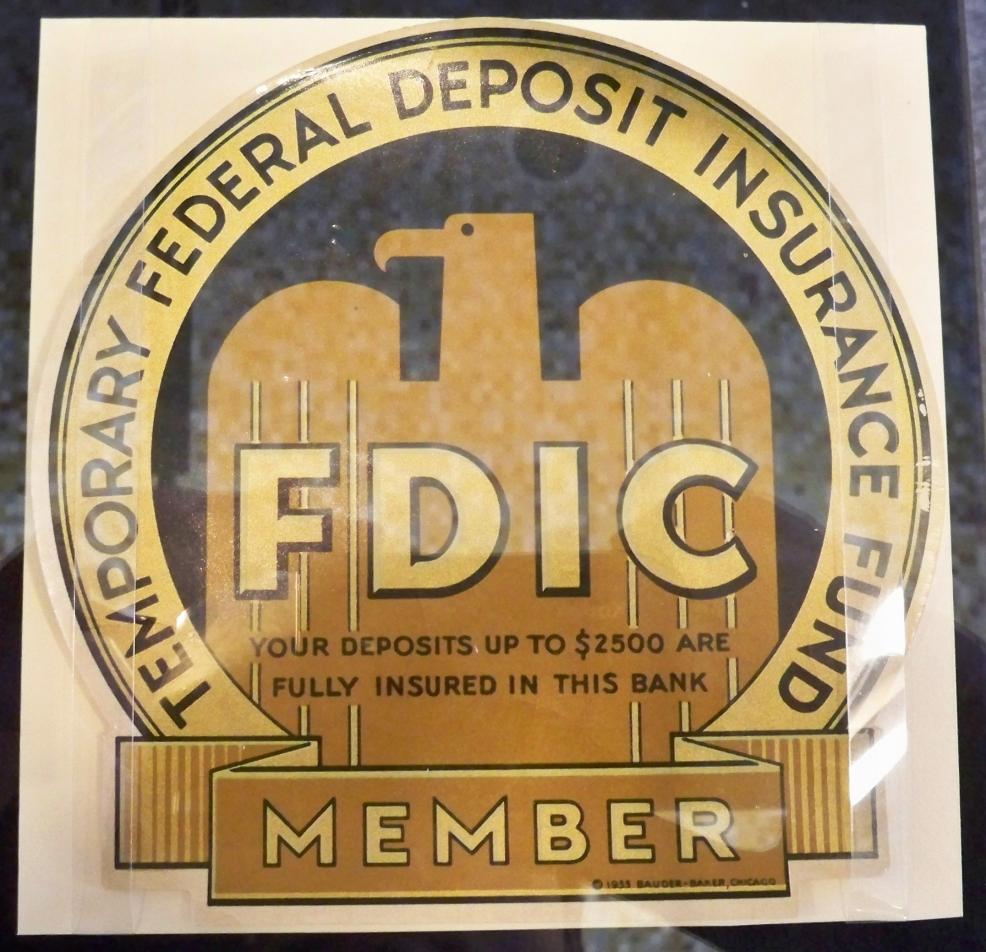

Since the deposit insurance fund creation in 1933, the Federal Deposit Insurance Corporation (FDIC) has collected assessments and managed a bank insurance fund. Based on information and experience gained from two banking crises, these systems have undergone evolution over time.